Loan Management System

Automate and Simplify Your Lending Operations

CREDION

|

Manual loan processing slows down approvals, increases errors, and frustrates borrowers. Credion helps Philippine lending companies streamline operations with one smart, secure, and scalable loan management system.

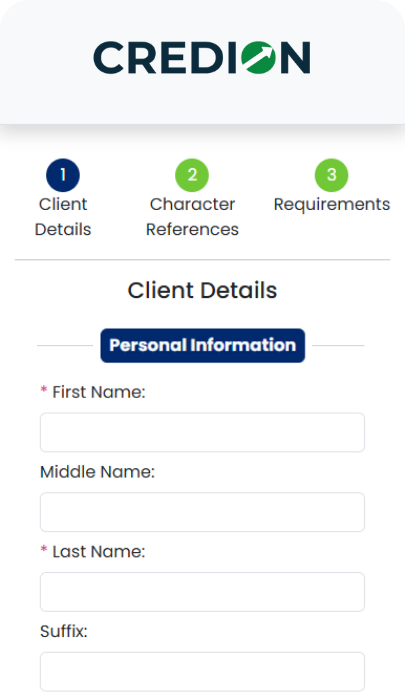

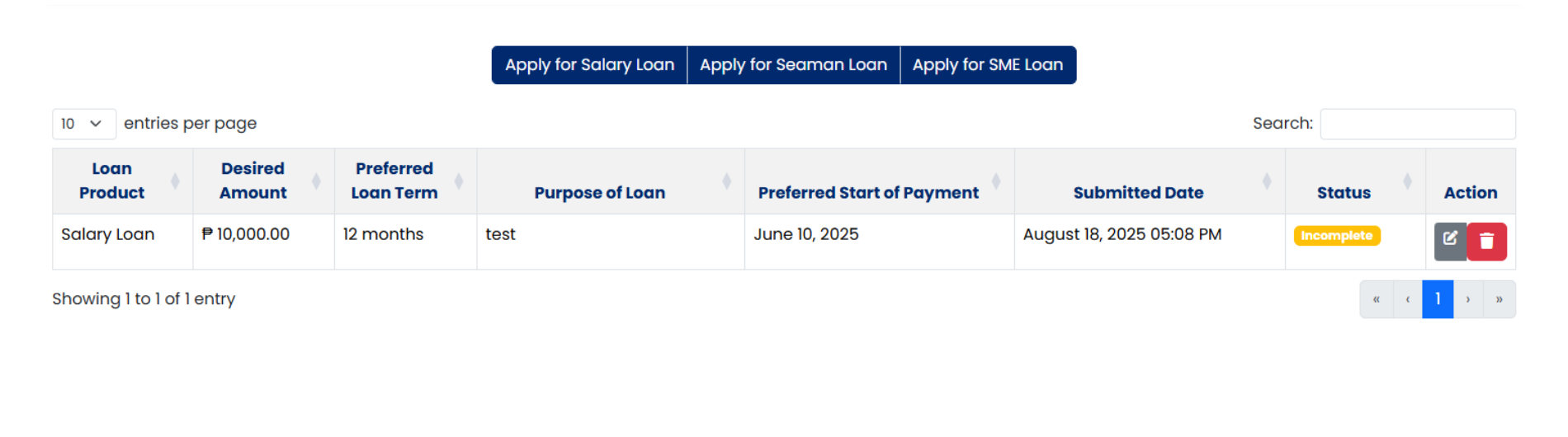

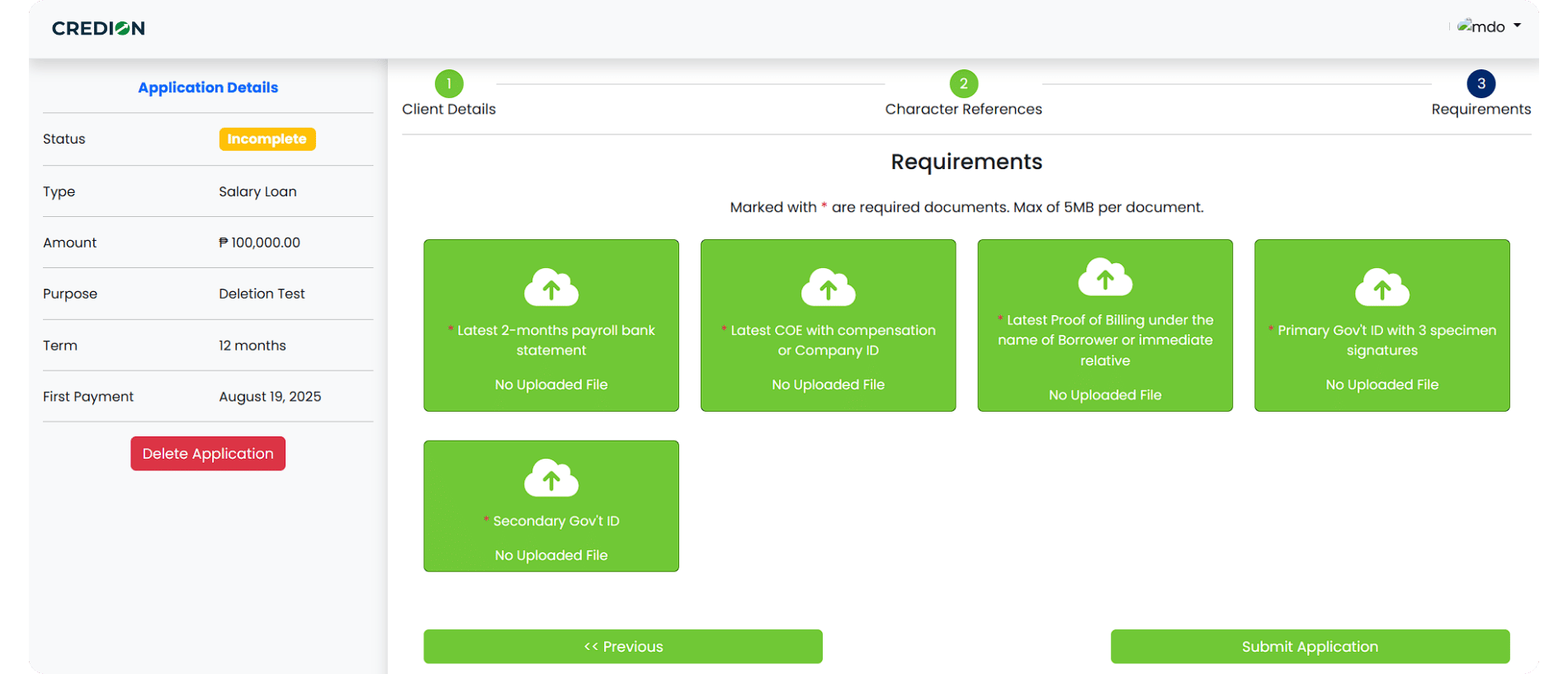

Smart and Simple Online Loan Applications

Borrowers can submit applications, upload documents, and receive real time eligibility results through a secure, mobile friendly portal, giving your institution faster processing and your clients a smoother experience.

Online loan applications with real-time eligibility checks

Allow borrowers to apply anytime through a secure online portal, while your system instantly checks their eligibility and provides immediate feedback.

Automated risk evaluation and approval workflows

Reduce delays and errors by letting Credion automatically assess credit risk, route applications to the right approvers, and finalize decisions faster.

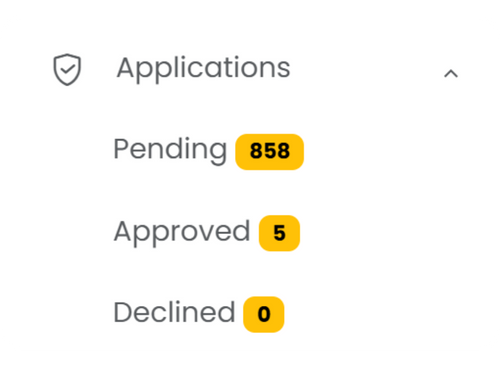

Application Dashboard

Give administrators and staff a centralized view of all loan applications, from pending and approved to declined, with real time status updates and actionable insights for faster decision making.

Custom loan products and terms configuration

Easily create and adjust loan types, interest rates, and repayment terms to match your institution’s policies without complex coding or system changes.

Document upload, co-borrower, and reference management

Collect required documents and manage co borrower or guarantor details in one place, ensuring compliance and smoother loan processing.

All-in-One Loan Management System for Fast, Compliant Lending

Streamline loan applications, approvals, and collections with end to end automation, purposefully built for lending firms, cooperatives, and rural banks in the Philippines. Credion’s Loan Management System empowers your organization to process loans faster, reduce errors, and stay fully compliant while delivering a seamless borrower experience.

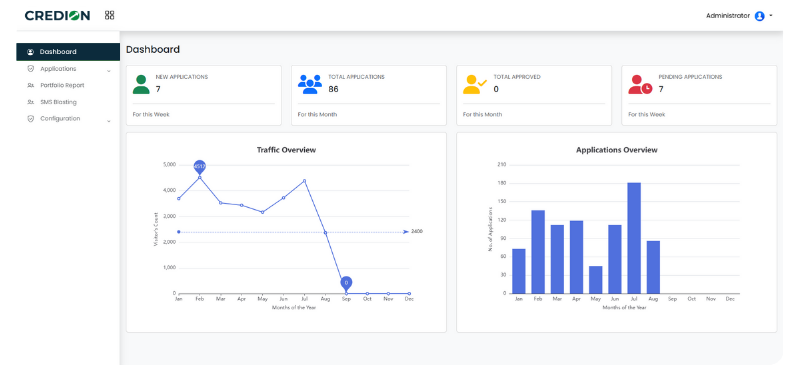

Role-based section for admins, reviewers, and borrowers

Provide each user with a personalized dashboard tailored to their role, ensuring clarity, security, and efficiency across the entire lending process.

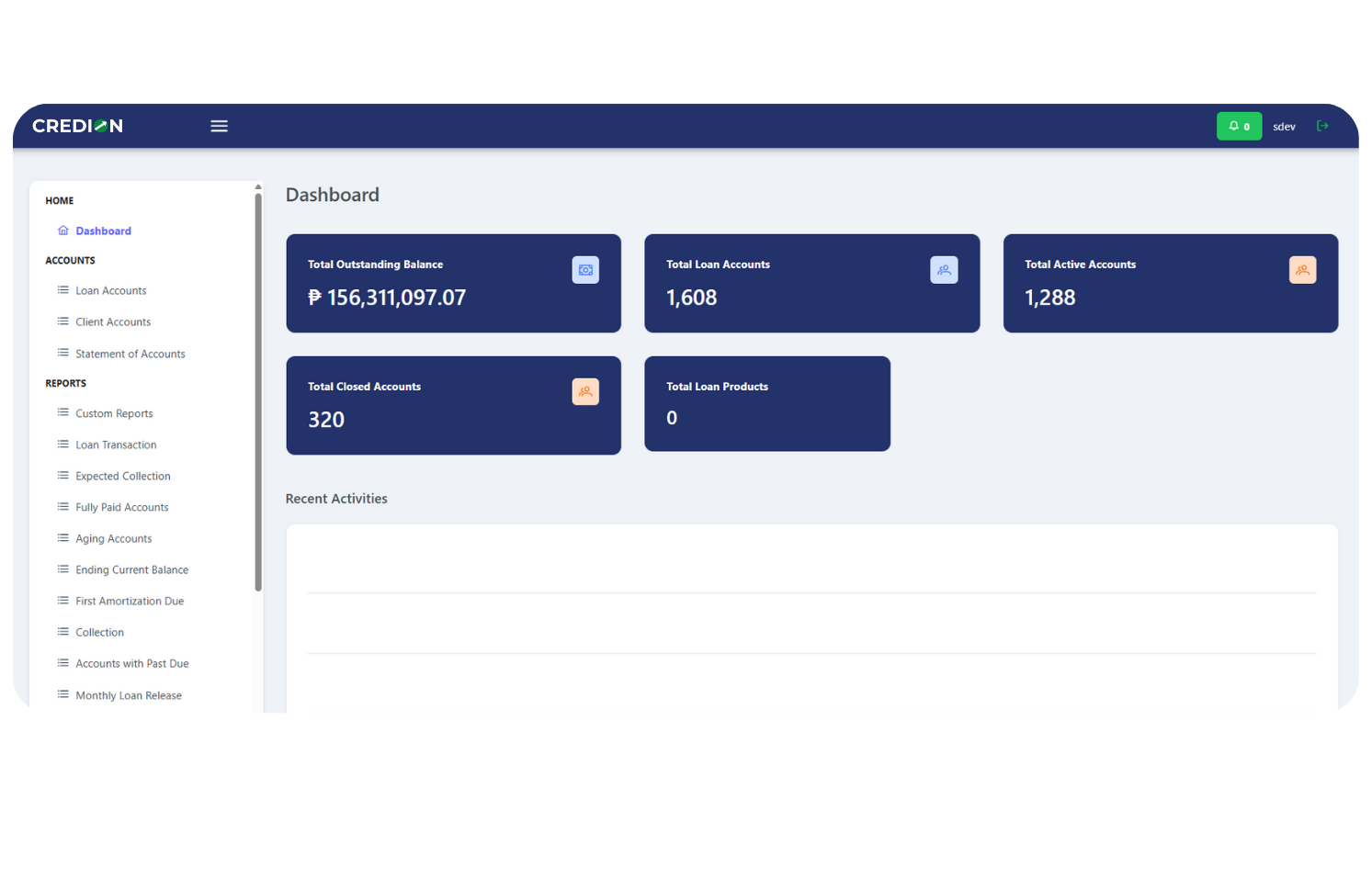

Loan Management System Dashboard

Monitor your lending operations in one intuitive interface that shows key metrics, loan statuses, and performance insights at a glance.

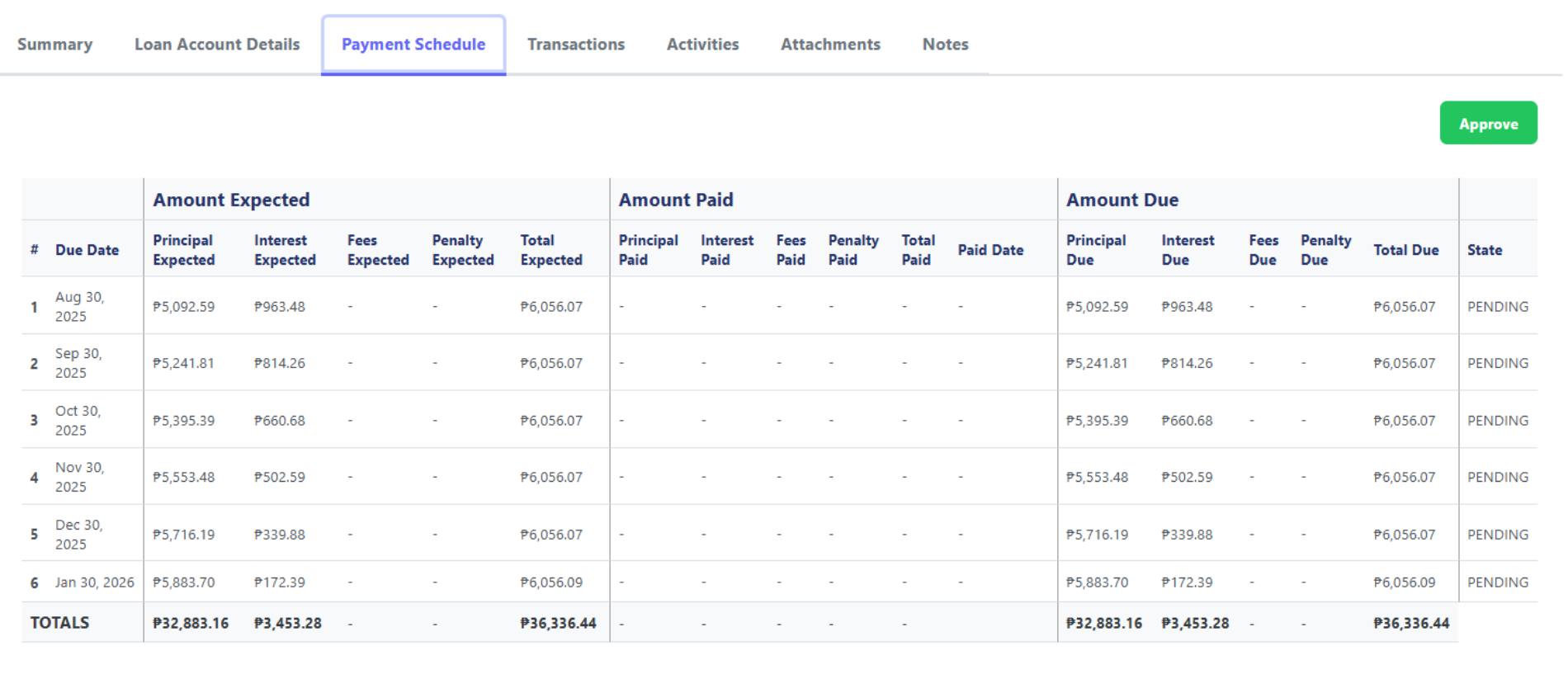

Amortization schedules, SOAs, and payment tracking

Automate the creation of repayment schedules, generate statements of account, and keep track of borrower payments in real time.

Automated SMS/email notifications

Keep borrowers and staff updated with automated reminders, alerts, and confirmations sent directly to their phones and inboxes.

Secure data, KYC, AML, and DPA compliance built in

Ensure that every transaction and record meets Philippine regulatory requirements, while safeguarding sensitive borrower information with enterprise grade security.

Why Choose Credion?

Credion Loan Management System is designed to give lending institutions a smarter way to operate. It combines automation, security, and scalability so your organization can process more loans, serve clients better, and stay fully compliant with industry standards.

- Built for lending firms, cooperatives, and rural banks

- Reduces manual work and errors by 70%

- Scales with your operations

- Fully mobile-responsive and cloud-hosted

- VAPT-tested and ready for audit

Find the most flexible Credion Loan Management System Plans and Prices

Starter

Growth

Enterprise

FAQs: Credion

Credion is a smart loan management system developed by SDEVtech. It streamlines the entire lending process, from online applications and risk evaluation to approval, disbursement, and repayment tracking. It is built to help institutions process loans faster, reduce errors, and remain fully compliant with Philippine regulations.

Credion is designed for a wide range of lending institutions, including rural and thrift banks, private lending companies, employee cooperatives, microfinance organizations, and fintech startups. Whether your institution is small, medium, or large, Credion can scale to meet your operational needs.

A loan management system is a software platform that automates and organizes the lending process. Instead of relying on manual spreadsheets or paper-based workflows, it allows institutions to manage applications, approvals, disbursements, repayments, and compliance requirements all in one secure, centralized system.

Yes, you can. Credion offers live demos of its loan management system that is actively used by lending companies, cooperatives, and financial institutions in the Philippine financial sector.

The demo walks you through end to end loan processing, borrower and account management, automated repayments, reporting, and compliance aligned with local regulatory requirements. Sessions can be done online or on site, allowing you to see how the system fits your specific lending operations and growth plans.

To request a demo, simply contact the Credion team and schedule a time that works best for your organization.

Several companies offer cloud-based loan management software suitable for Philippine lenders, including Credion, which provides a scalable platform built for compliant lending operations in the local market. Other global and regional providers that support cloud-based loan servicing and origination include Mambu, Finastra, Temenos, and Oracle Financial Services, all of which can be configured to meet the regulatory and operational needs of banks, cooperatives and lending companies.

When choosing a provider, consider factors like support for local compliance requirements, ease of integration with your existing systems, pricing, security standards and service reliability to ensure the best fit for your lending institution.

For small businesses in the Philippines looking for loan management systems, some of the best options are those that combine affordability, ease of use, compliance support and scalability. Credion is a strong choice because it offers cloud-based loan origination, servicing, automated workflows and reporting tailored for Philippine lenders. Other systems that work well for small lenders and microfinance institutions include Mambu, BlueVine, and TurnKey Lender, each providing flexible cloud platforms that can be adapted to local compliance needs.

When evaluating these systems, small business lenders should consider factors like pricing, ease of setup, customer support availability, security standards, and how well the system integrates with existing accounting or banking tools to ensure efficient loan operations.

Ready to Transform Your Lending Process?

Whether you’re a lending company, cooperative, or bank—Credion Loan Management System is ready to scale with you.